Apple was hit with a proposed securities fraud class action on Friday, accused of misleading shareholders about the timeline for integrating advanced artificial intelligence into its Siri voice assistant—a delay that allegedly hurt iPhone sales and triggered a steep decline in its stock price.

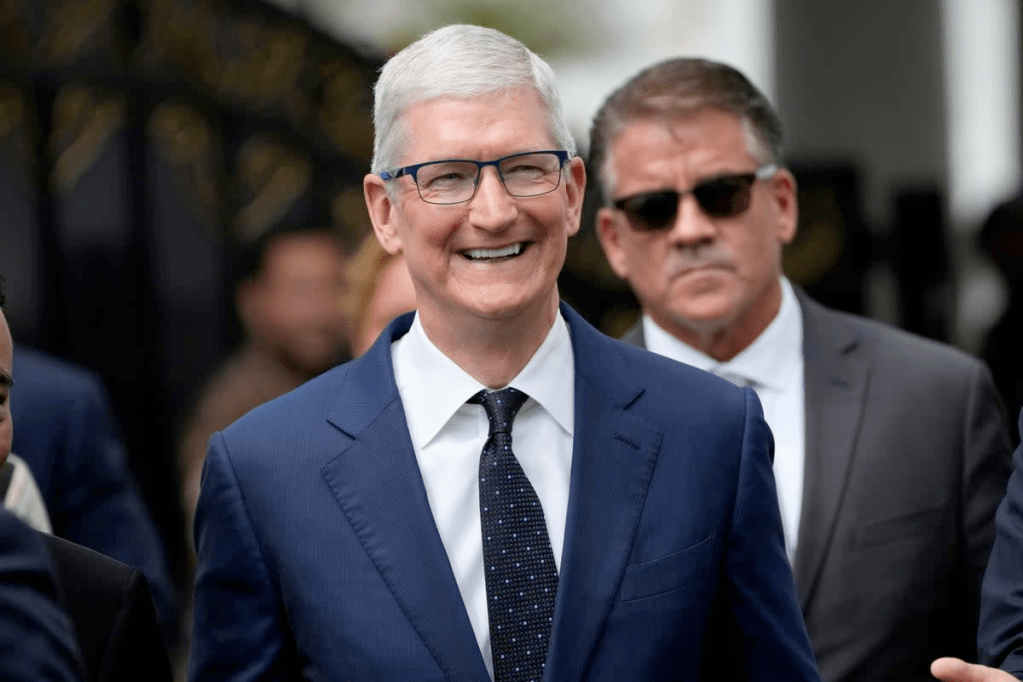

The lawsuit, filed in federal court in San Francisco, names Apple CEO Tim Cook, Chief Financial Officer Kevan Parekh, and former CFO Luca Maestri as defendants. It seeks to recover potentially hundreds of billions of dollars in losses for shareholders over the past year.

The complaint alleges that Apple fostered unrealistic expectations about AI enhancements for the iPhone 16 during its June 2024 Worldwide Developers Conference, where it unveiled “Apple Intelligence”—a suite of upgrades meant to make Siri more powerful and user-friendly. However, shareholders claim the company lacked a functional AI-powered Siri prototype at the time and knew the features would not be ready for the iPhone 16’s release.

The truth, plaintiffs argue, began surfacing in March when Apple pushed some Siri improvements to 2026—a delay that became more apparent at this year’s developer conference on June 9, where Apple’s AI progress fell short of analyst expectations.

Since hitting a record high on Dec. 26, 2024, Apple’s stock has plummeted nearly 25%, erasing roughly $900 billion in market value. The company did not immediately respond to requests for comment.

The case underscores growing scrutiny over tech companies’ AI promises as investors weigh the gap between hype and deliverable innovation.

Leave a comment